無料ダウンロード yield to maturity of a coupon bond calculator 112198-Yield to maturity of a coupon bond calculator

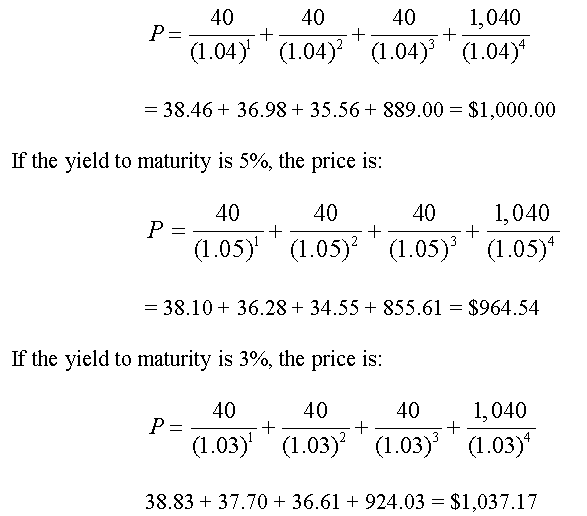

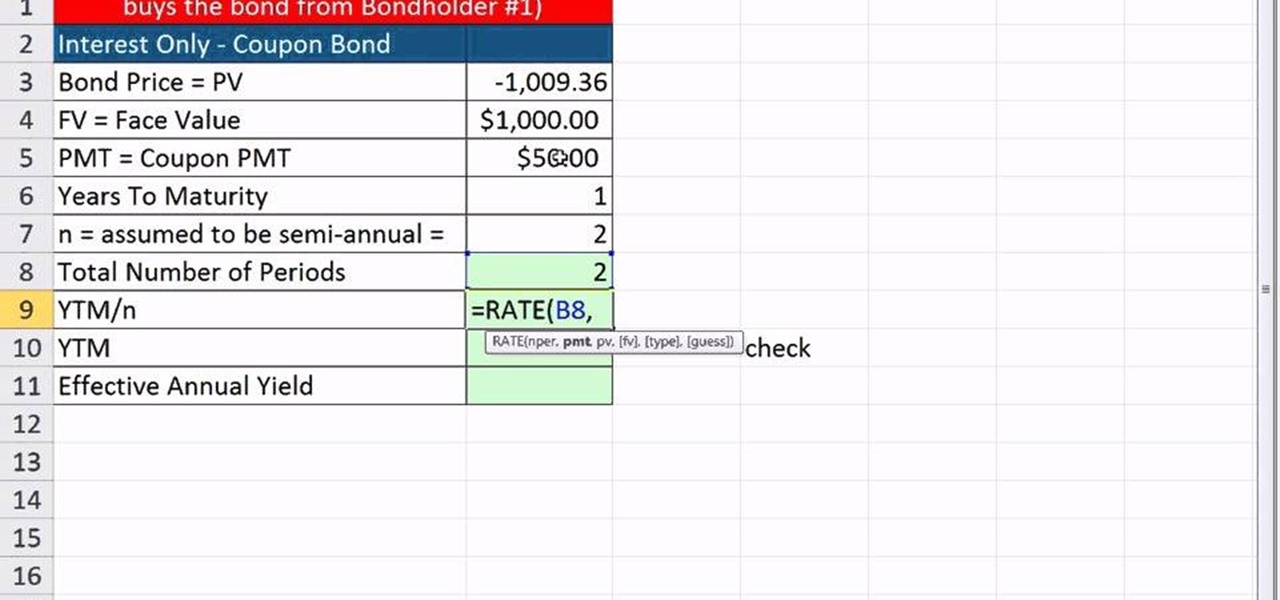

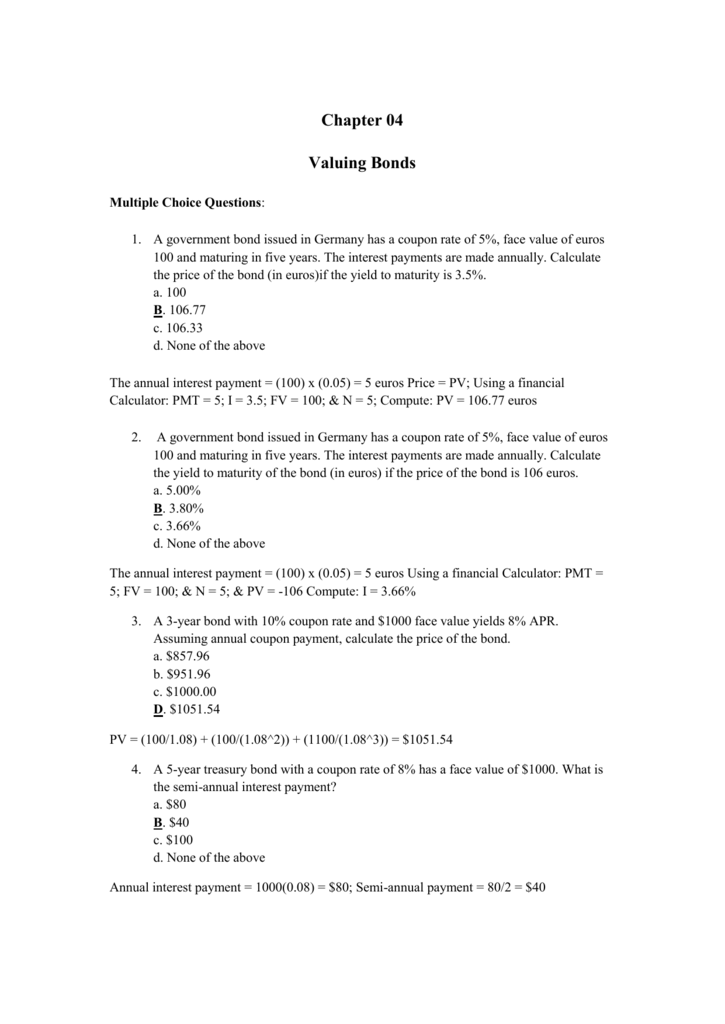

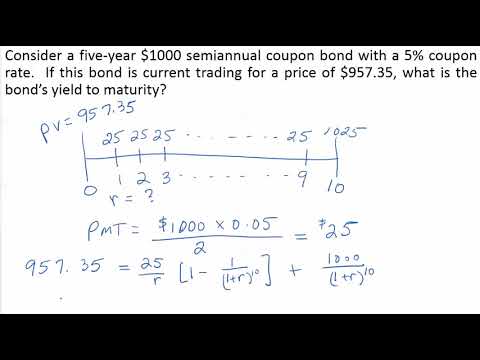

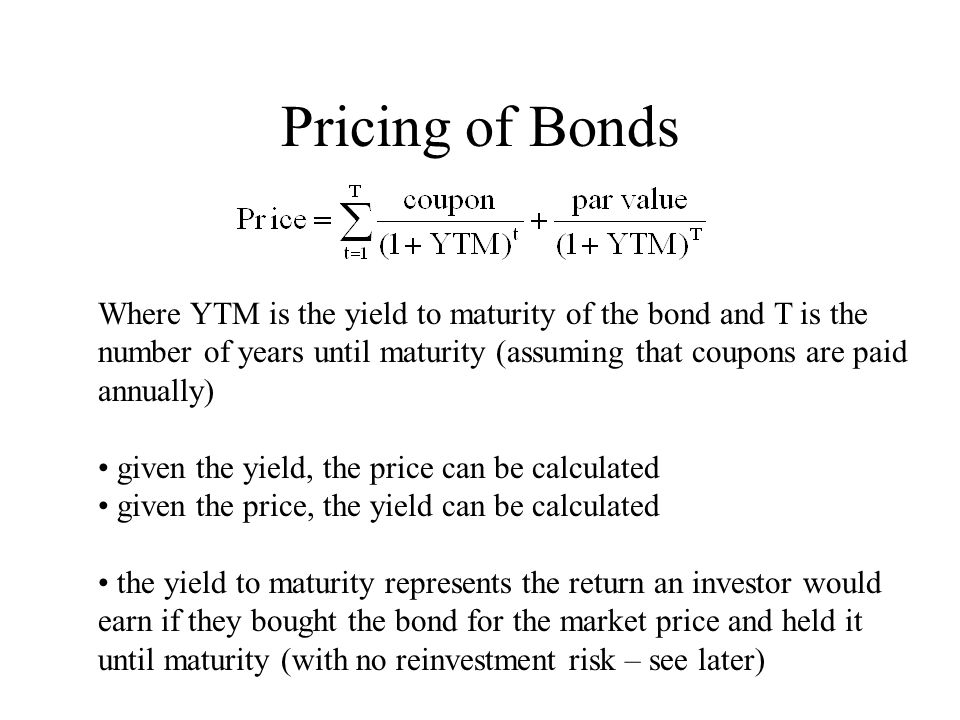

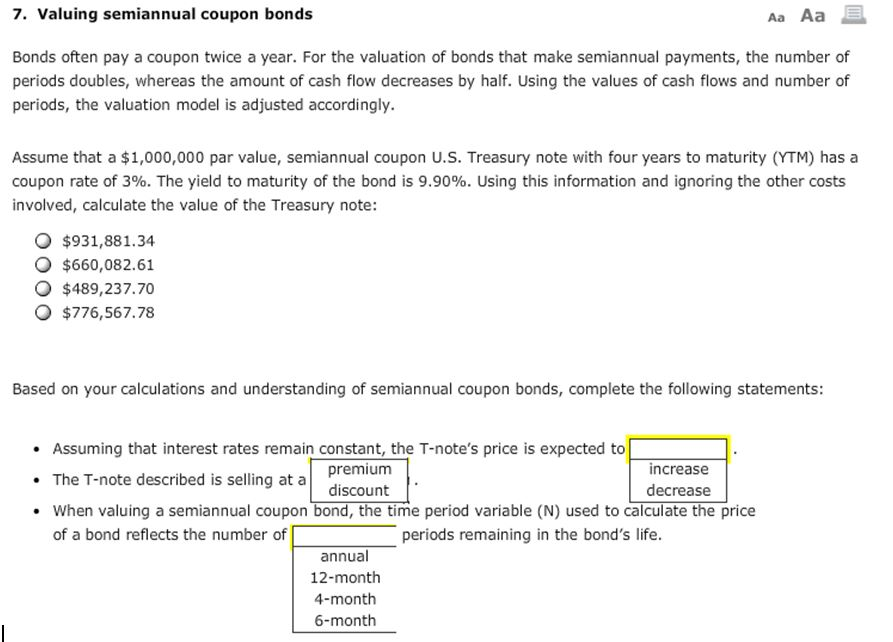

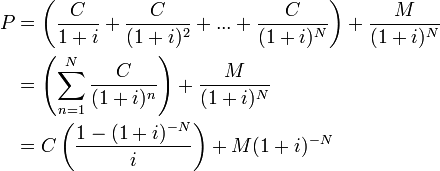

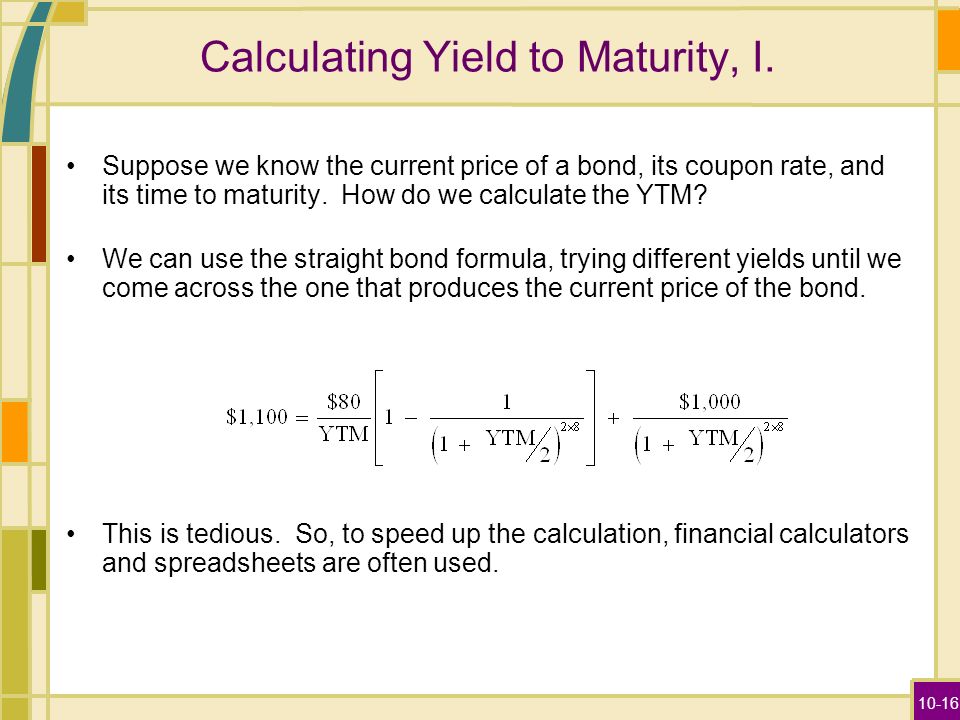

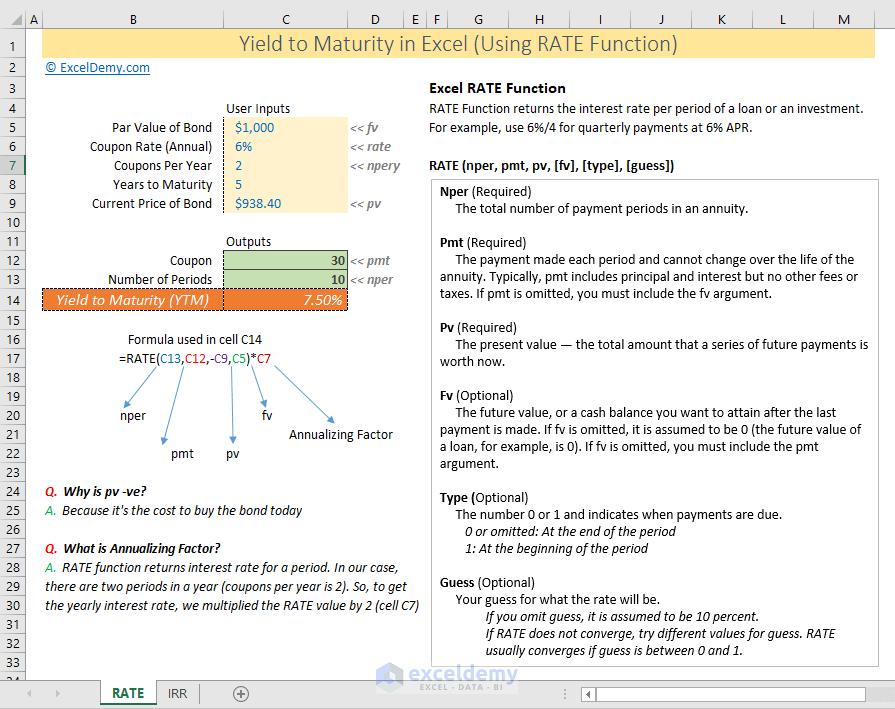

To calculate the price for a given yield to maturity see the Bond Price Calculator Face Value This is the nominal value of debt that the bond represents It is the amount that is payed to the holder of the bond on the date that it matures, also called the redemption date Coupon RateNper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10 Pmt = The payment made in every period It cannot change over the life of the bond The coupon rate is 6% But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%Bond Yield Calculator – Compute the Current Yield CODES (2 days ago) On this page is a bond yield calculator to calculate the current yield of a bond Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield

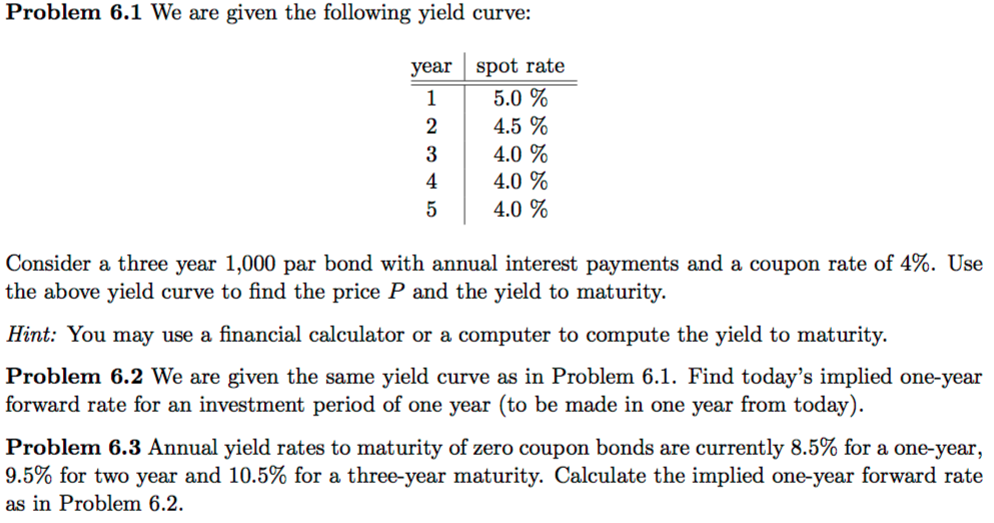

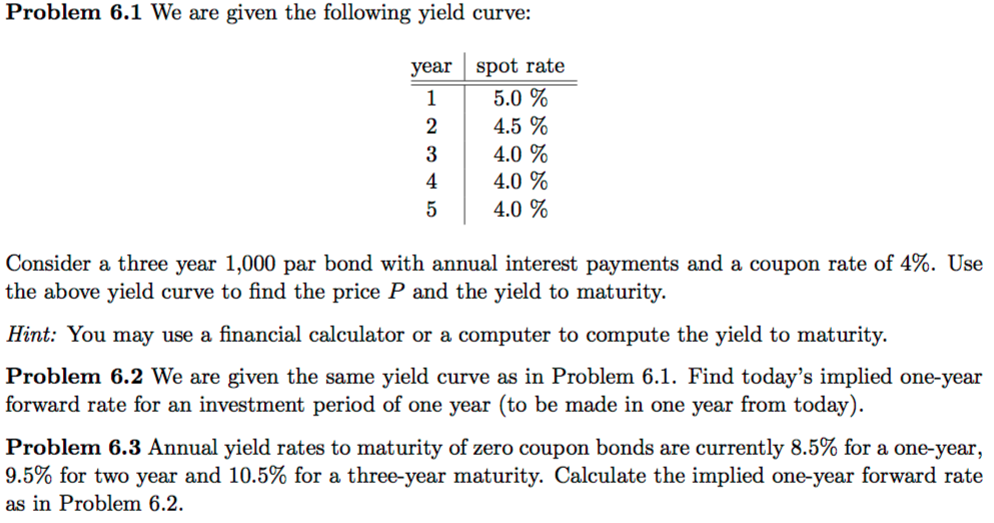

Solved Problem 6 1 We Are Given The Following Yield Curve Chegg Com

Yield to maturity of a coupon bond calculator

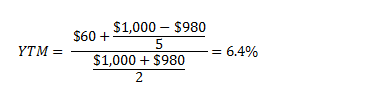

Yield to maturity of a coupon bond calculator-Calculate the yield to maturity on the following bonds A 9 percent coupon (paid semiannually) bond, with a $1,000 face value and 15 years remaining to maturity The bond is selling at $985 An 8 percent coupon (paid quarterly) bond, with a $1,000 face value and 10 years remaining to maturity The bond is selling at $915Bond Yield to Maturity Calculator Use the Bond Yield to Maturity Calculator to compute the current yield and yield to maturity for a bond with a specified face (par) value, current value, coupon rate and years to maturity The calculator assumes one coupon payment per year at the end of the year

Yield To Maturity Fixed Income

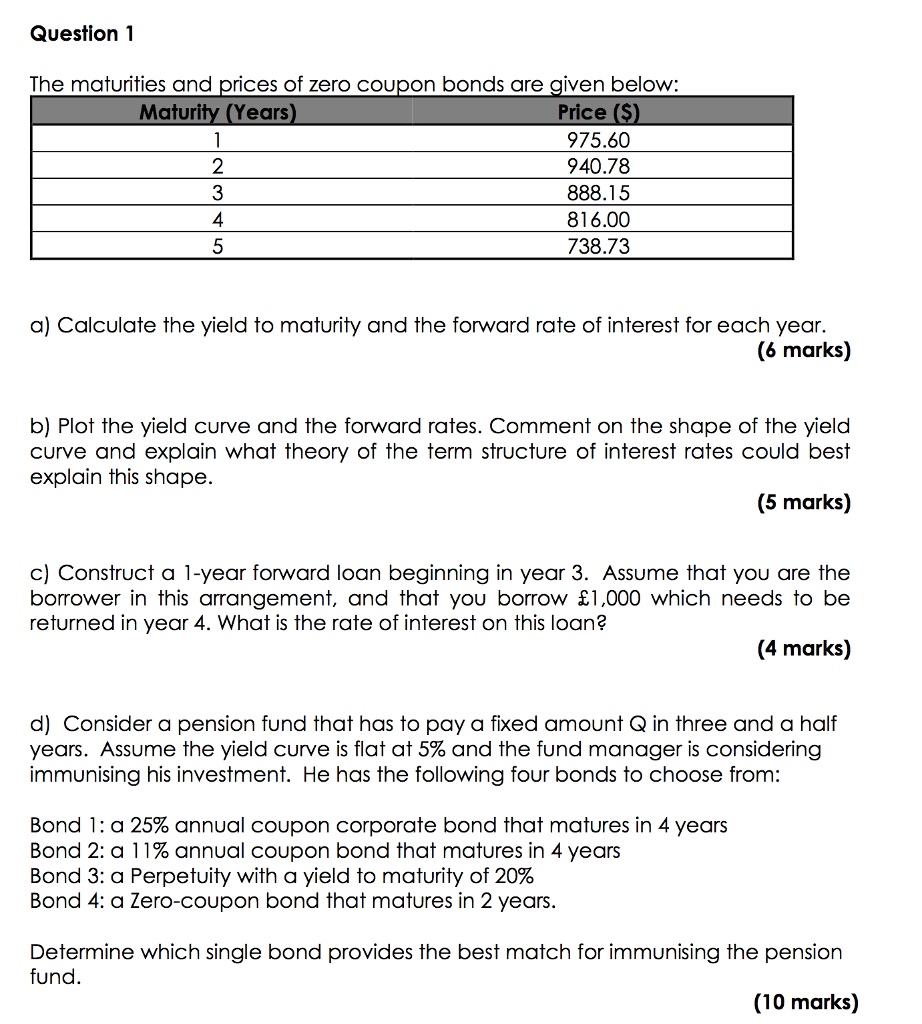

Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10 Pmt = The payment made in every period It cannot change over the life of the bond The coupon rate is 6% But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%The following is a list of prices for zerocoupon bonds of various maturities a Calculate the yield to maturity for a bond with a maturity of (i) one year;With links to articles for more information

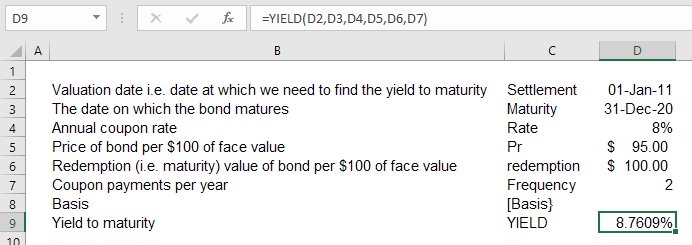

On this page is a bond yield calculator to calculate the current yield of a bond Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formulaYield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingThe Bond Yield to Maturity Calculator is used to calculate the bond yield to maturity Bond Yield to Maturity Definition The bond yield to maturity (abbreviated as Bond YTM) is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity and that all coupon

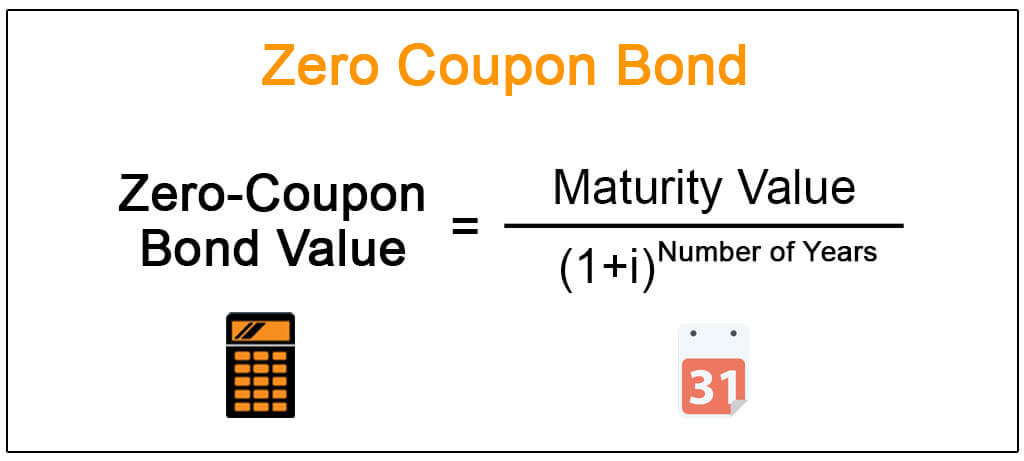

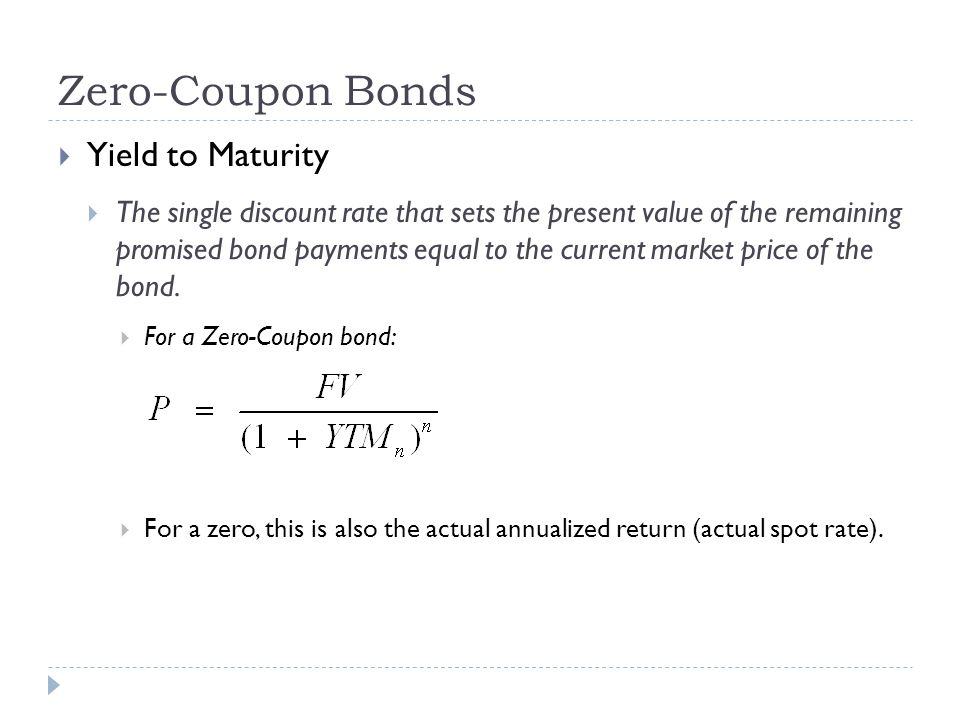

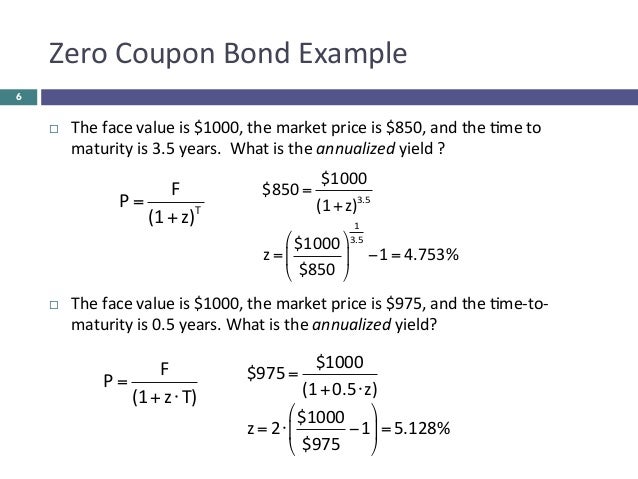

Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get Subtract 1, and you have , which is %The calculator, uses the following formulas to compute the present value of a bond Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 (Market Rate / 100) ^ Number Payments) / Number Payments)To calculate the price for a given yield to maturity see the Bond Price Calculator Face Value This is the nominal value of debt that the bond represents It is the amount that is payed to the holder of the bond on the date that it matures, also called the redemption date Coupon Rate

An Introduction To Bonds Bond Valuation Bond Pricing

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

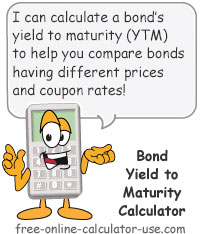

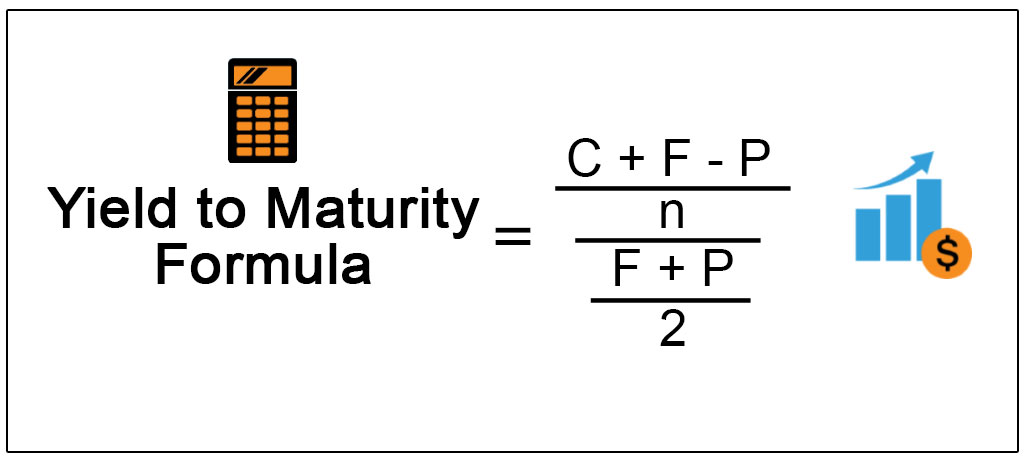

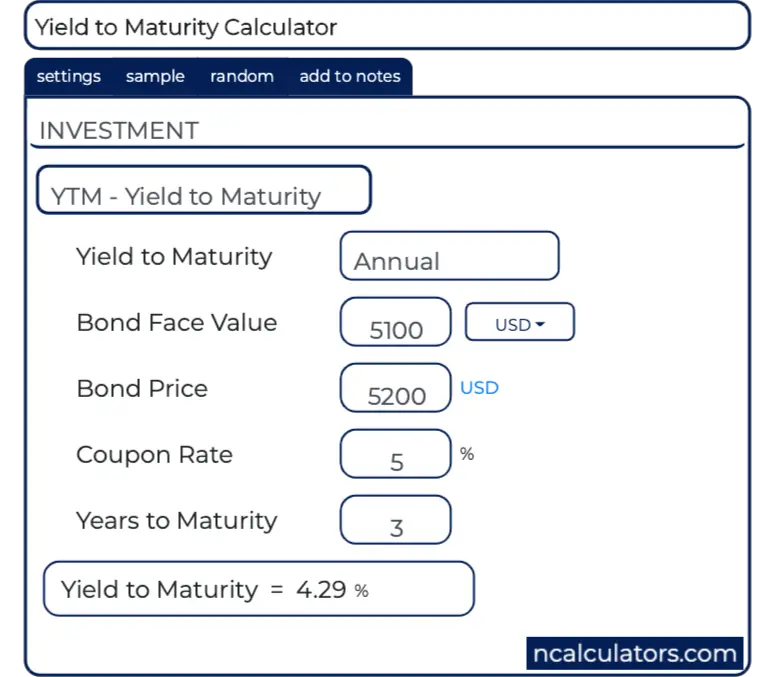

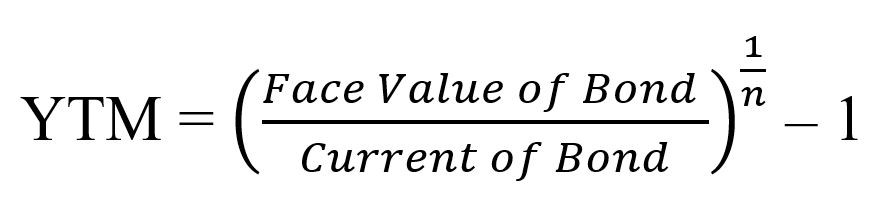

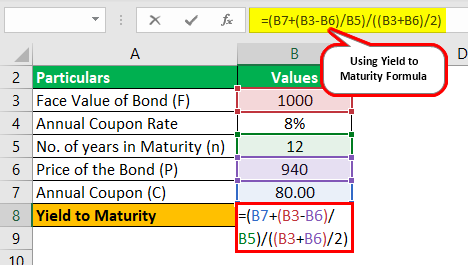

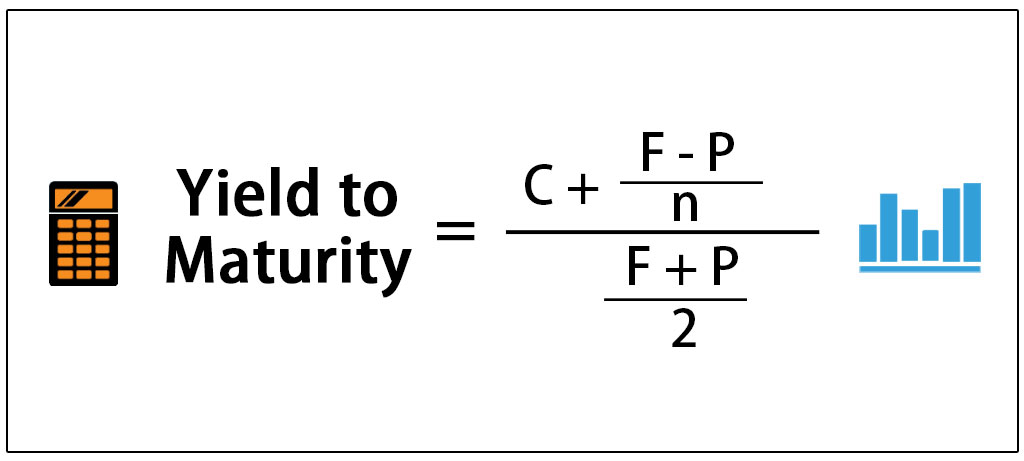

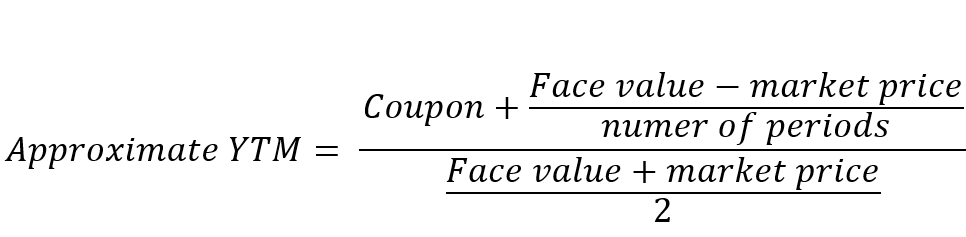

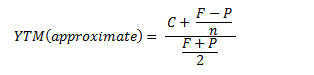

Bond Yield to Maturity Calculator Bond Price Face Value Coupon Rate (%) Years to Maturity CompoundingYield to Maturity Formula refers to the formula that is used in order to calculate total return which is anticipated on the bond in case the same is held till its maturity and as per the formula Yield to Maturity is calculated by subtracting the present value of security from face value of security, divide them by number of years for maturity and add them with coupon payment and after that dividing the resultant with sum of present value of security and face value of security divided by 2Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity

Zero Coupon Bond Definition Formula Examples Calculations

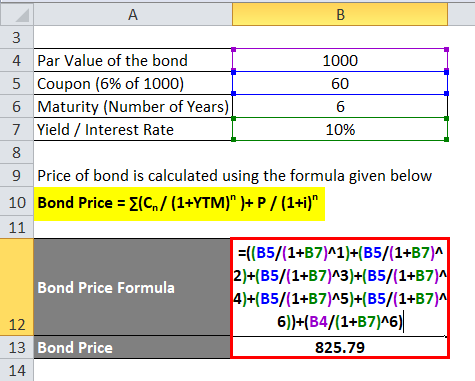

How To Calculate Bond Price In Excel

Bond Yield Calculator CalculateStuffcom CODES (3 days ago) The yield to maturity is the discount rate that equates the present value of all future cashflows of the bond (coupon payments and payment of face value) and the current price of the bond We must assume that all payments are made on time, and we must assume that the bond is held to maturityTo apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variables C = 1000*008 = 80Bond Yield Current Price Par Value Coupon Rate % Years to Maturity Calculate Current Yield % Yield to Maturity %

Coupon Rate Vs Yield Rate For Bonds Wall Street Oasis

Chapter 05

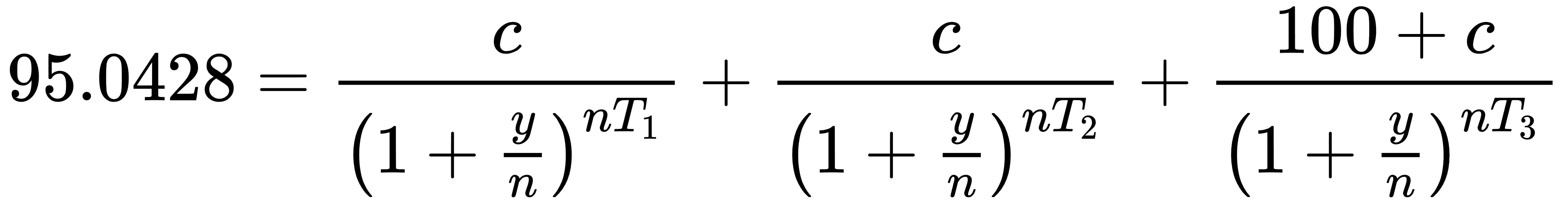

Calculate either a bond's price or its yieldtomaturity plus over a dozen other attributes with this fullfeatured bond calculator If you are considering investing in a bond, and the quoted price is $9350, enter a "0" for yieldtomaturity Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yieldThe calculator uses the following formula to calculate the yield to maturity P = C× (1 r) 1 C× (1 r) 2 C× (1 r) Y B× (1 r) Y(27 days ago) Zero Coupon Yield To Maturity Calculator, 0221 (3 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

How To Calculate Yield To Maturity In Excel With Template Exceldemy

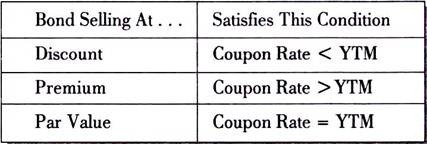

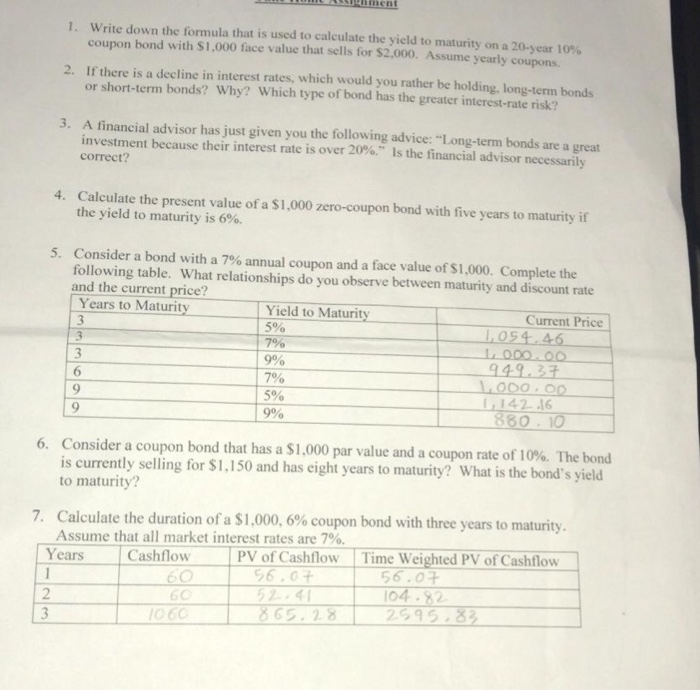

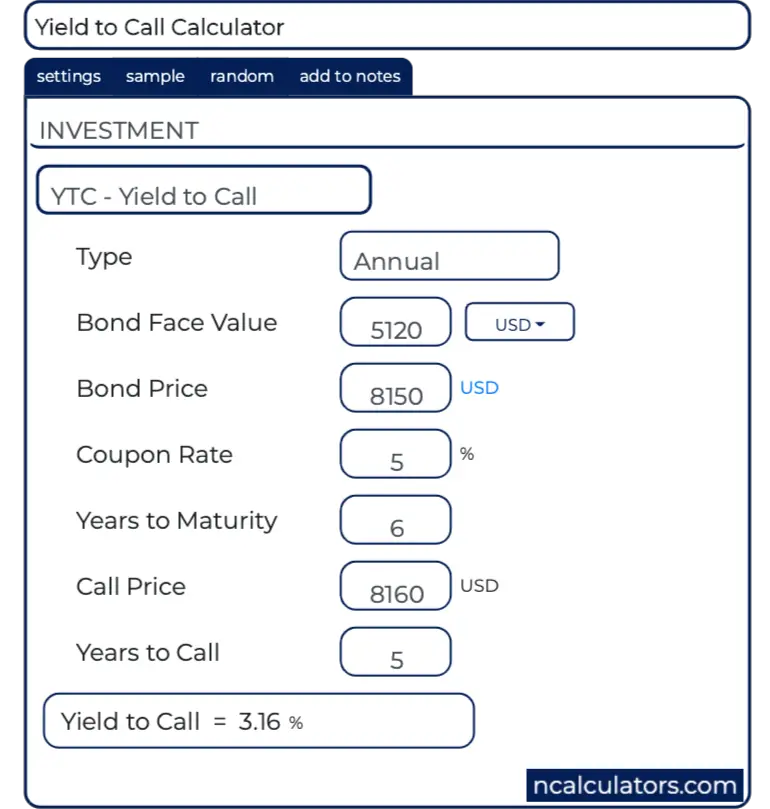

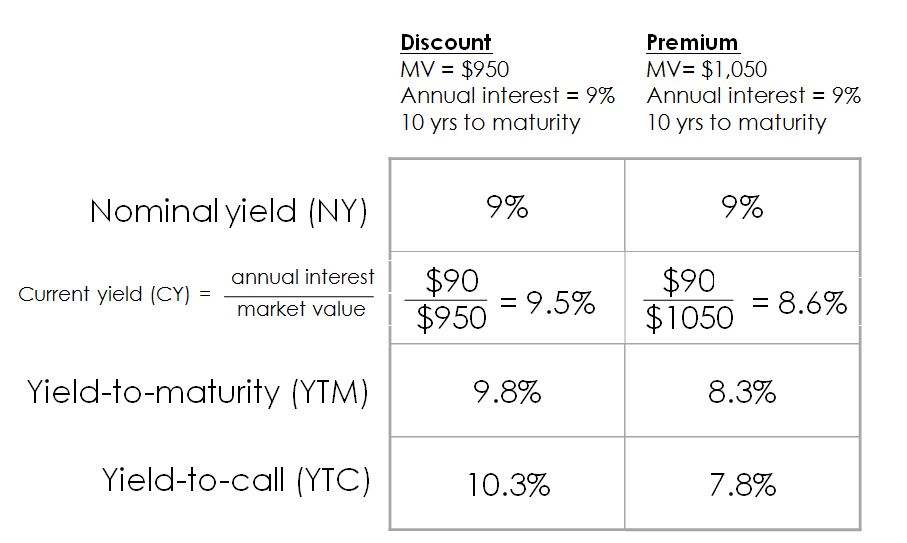

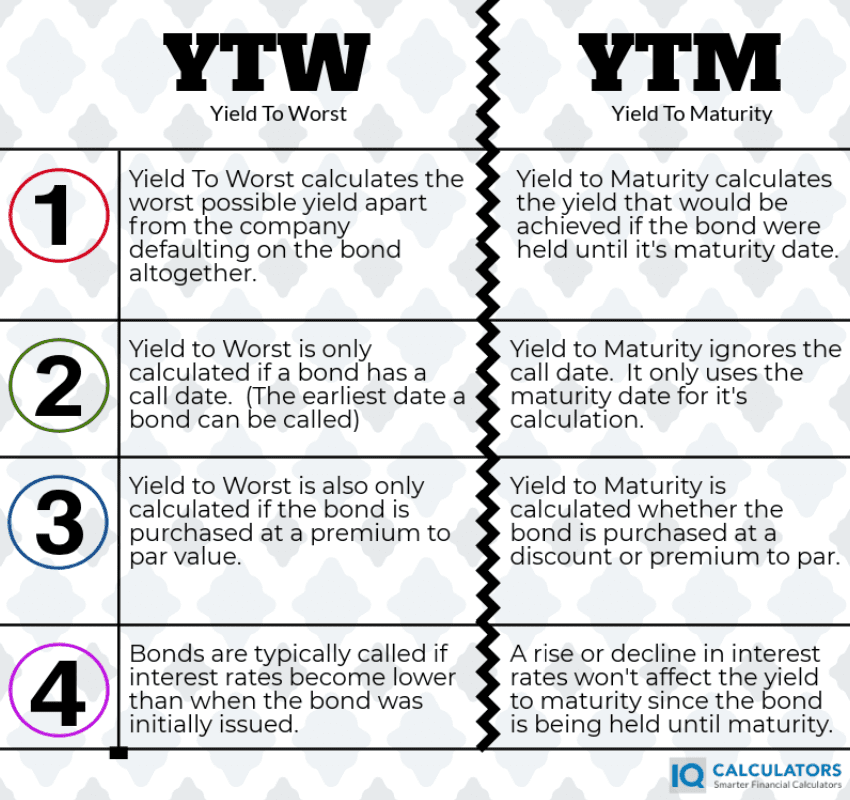

Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturityEE 518 Homework #6 Due on Thursday, March 19, Problem 1 Consider a bond with face value $100, coupon rate 5%, yield if 6 5%, and years to maturity Calculate the price of the bond for (a) annual coupon (b) semiannual coupon (c) quarter coupon (d) zero coupon Problem 2 (a) Consider an annualcoupon bond with face value $100 and years to maturityCurrent yield is the bond's coupon yield divided by its market price A bond return calculator will allow you to calculate yield to maturity (YTM) and yield to call (YTC) which takes into account the impact on a bond's yield if it is called prior to maturity The yield to worst (YTW) will be the lowest of the YTM and YTC

Bond Value Calculator What It Should Be Trading At Shows Work

Calculate The Yield To Maturity Current Yield And Capital Gains Yield For A 12 Coupon Bond Homeworklib

(4 days ago) = Yield to Maturity (YTM) To calculate a bond's yield to maturity, enter the face value (also known as "par value"), the coupon rate, the number of years to maturity, the frequency of payments, and the current price of the bondCODES (7 days ago) COUPON (2 days ago) (3 months ago) Calculate the price of a sixyear $1,000 facevalue bond with a 7% annual coupon rate and a yieldtomaturity of 6% with semiannual coupon payments $1,050 A tenyear $10,000 facevalue bond with semiannual coupon payments has an 8% annual coupon rate and a 9% annual YTMThe calculator, uses the following formulas to compute the present value of a bond Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 (Market Rate / 100) ^ Number Payments) / Number Payments)

Ytm Yield To Maturity Calculator

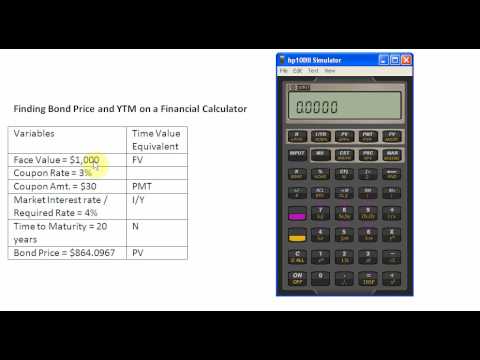

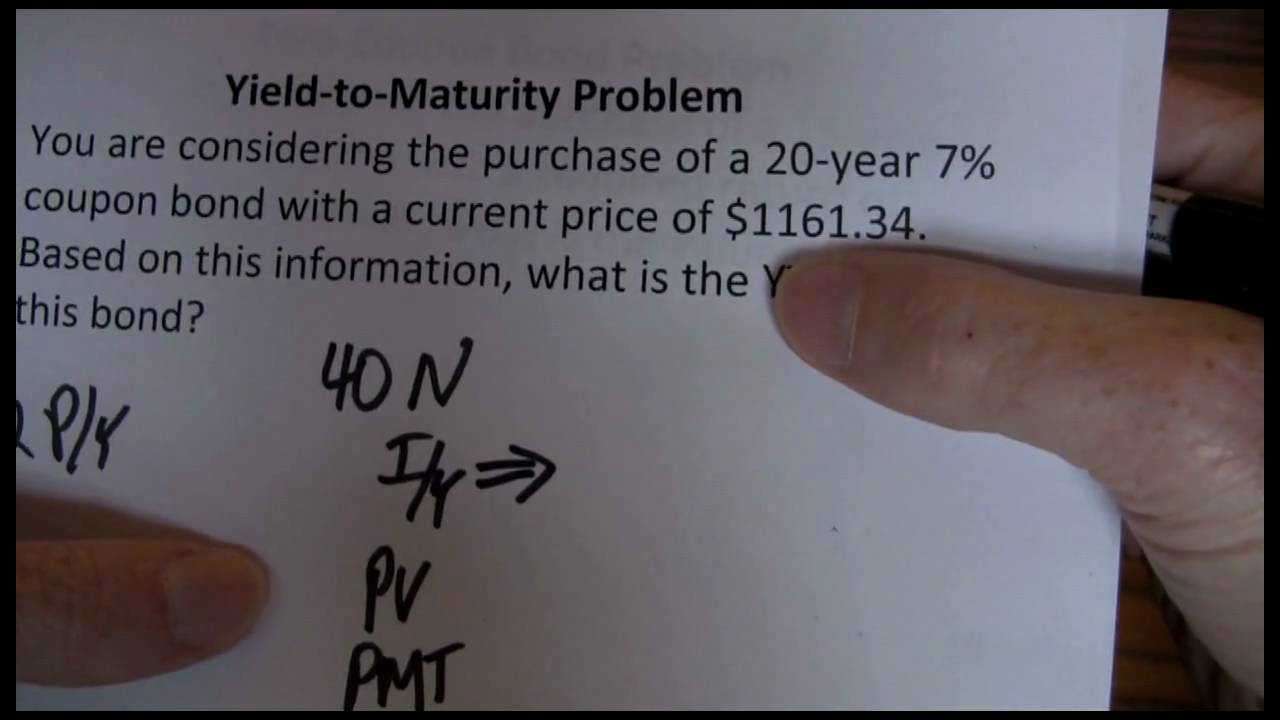

Finding Bond Price And Ytm On A Financial Calculator Youtube

Yield to Maturity Calculator Good Calculators CODES (2 days ago) You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the resultsYield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity The formula for calculating YTM is shown belowThis yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturity

Youtube Bond Maturity

Bond Pricing Formula How To Calculate Bond Price

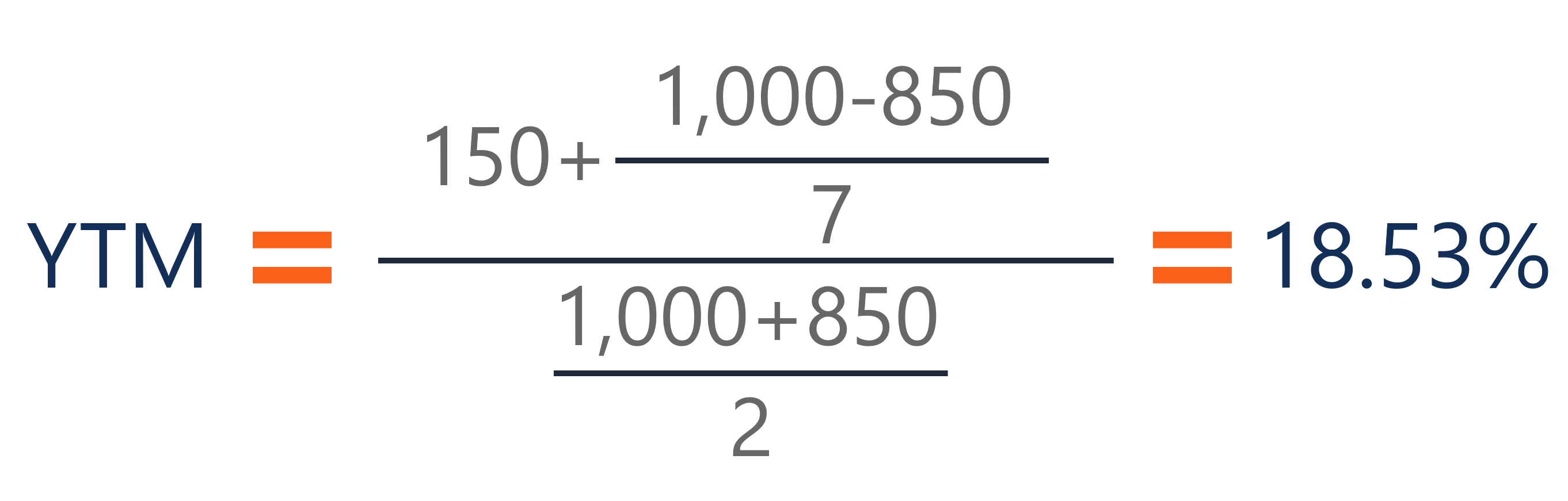

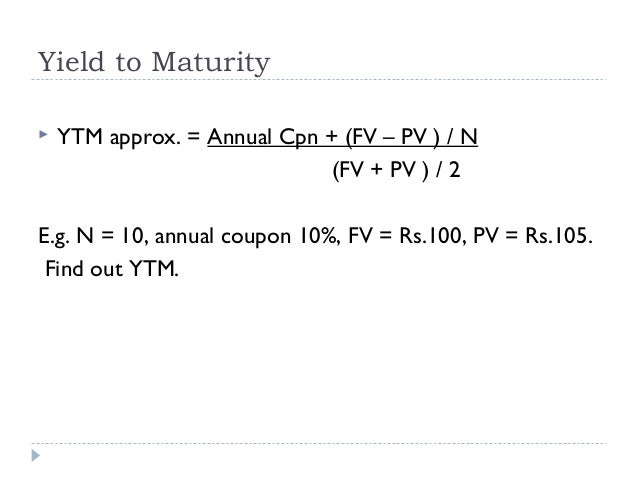

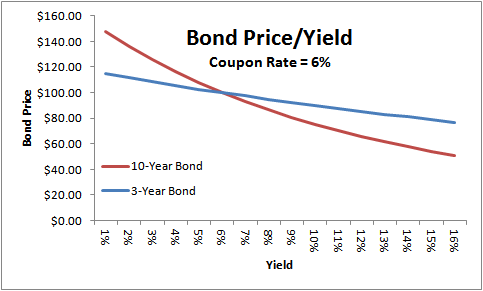

Generally, this will be different than the actual coupon rate on a bond see our bond yield to maturity calculator for more (this is essentially the inverse of this operation) Years to Maturity The number of years remaining until the bond pays out the face value You may use decimals here 9 years and 6 months is 95 years, for exampleThis free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon ratesThe price of the bond is $1,, and the face value of the bond is $1,000 The coupon rate is 75% on the bond Based on this information, you are required to calculate the approximate yield to maturity on the bond Solution Use the belowgiven data for calculation of yield to maturity

Yield To Maturity Formula Step By Step Calculation With Examples

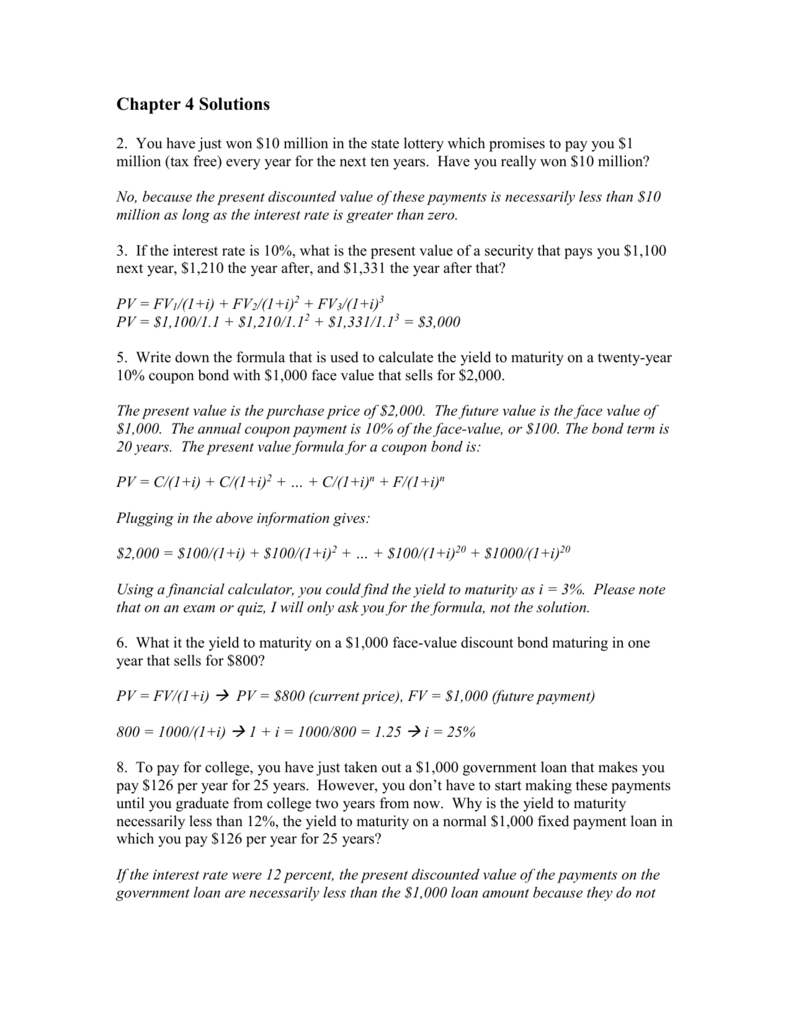

Chapter 4 Solutions

Bond Yield Calculator CalculateStuffcom CODES (3 days ago) The yield to maturity is the discount rate that equates the present value of all future cashflows of the bond (coupon payments and payment of face value) and the current price of the bond We must assume that all payments are made on time, and we must assume that the bond is held to maturityYield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingCurrent yield is the bond's coupon yield divided by its market price A bond return calculator will allow you to calculate yield to maturity (YTM) and yield to call (YTC) which takes into account the impact on a bond's yield if it is called prior to maturity The yield to worst (YTW) will be the lowest of the YTM and YTC

Calculate The Ytm Of A Coupon Bond Youtube

Vba To Calculate Yield To Maturity Of A Bond

(iv) four years (Do not round intermediate calculations Round your answers to two decimal places)Bond Yield to Maturity (YTM) Calculator On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on timeConsider a $1,000 zerocoupon bond that has two years until maturityThe bond is currently valued at $925, the price at which it could be purchased today The formula would look as follows (1000

How To Calculate Yield To Maturity 9 Steps With Pictures

What Is The Yield To Maturity Ytm Of A Zero Coupon Bond With A Face Value Of 1 000 Current Price Of 0 And Maturity Of 4 0 Years Recall That The Compounding Interval

Bond Calculator Instruction The Bond Calculator can be used to calculate Bond Price and to determine the YieldtoMaturity and YieldtoCall on Bonds Bond Price Field The Price of the bond is calculated or entered in this field Enter amount in negative valueThis free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon rates Also on this pageThe bond yield formula is the formula used to calculate the return on bonds invested and is based on the purchase price and interest amount prescribed The interest amount prescribed is also known as the coupon rate The coupon rate is nothing but the amount mentioned for a certain payment, which is mandatory Bond yield is of two types

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

Yield To Maturity Ytm Definition Formula And Example

The term "yield to maturity" or YTM refers to the return expected from a bond over its entire investment period until maturity YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTMThe procedure for finding the yield to maturity inbetween coupon payment dates is identical, except that you need to enter the current market price (the clean price) of the bond for Price and then solve for the yield (YTM) Remember to enter the price as a percentage of the face valueThe Bond Calculator can be used to calculate Bond Price and to determine the YieldtoMaturity and YieldtoCall on Bonds Bond Price Field The Price of the bond is calculated or entered in this field

Yield To Maturity Ytm Overview Formula And Importance

Zero Coupon Bonds Invest In Zero Coupon Bonds Today

Calculate either a bond's price or its yieldtomaturity plus over a dozen other attributes with this fullfeatured bond calculator If you are considering investing in a bond, and the quoted price is $9350, enter a "0" for yieldtomaturity Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yieldThe bond has a face value of $1,000, a coupon rate of 8% per year paid semiannually, and three years to maturity We found that the current value of the bond is $ For the sake of simplicity, we will assume that the current market price of the bond is the same as the value= Yield to Maturity (YTM) To calculate a bond's yield to maturity, enter the face value (also known as "par value"), the coupon rate, the number of years to maturity, the frequency of payments, and the current price of the bond Example of Calculating Yield to Maturity For example, you buy a bond with a $1,000 face value and 8% coupon for $900

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Solved Problem 6 1 We Are Given The Following Yield Curve Chegg Com

For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000 Although no coupons are paid periodically, the investor will receive the return upon maturity or upon sell assuming that the rates remain constant Zero Coupon Bond Effective Yield Formula vs BEY Formula The zero coupon bond effectiveFace/par value which is the amount of money the bond holder expects to receive from the issuer at the maturity date as agreed Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value Coupon rate compounding frequency that can be Annually, Semiannually, Quarterly si MonthlyThis calculator shows the current yield and yield to maturity on a bond;

Bond Pricing Formula How To Calculate Bond Price

21 Cfa Level I Exam Cfa Study Preparation

Without clearing the Bond registers, change the maturity date Input 14 15 Press 12 4 15 5 should be displayed Store the new call value Input 105 Press should be displayed Calculate the yield Press 454% should be displayed The yield to call would be 454%

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube

What Is Yield To Maturity How To Calculate It Scripbox

Bond Valuation

Yield To Maturity Calculator Zero Coupon Bond

1

Chapter 4 Valuation And Bond Analysis Business Finance Essentials

Yield To Maturity Approximate Formula With Calculator

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Calculating The Yield Of A Zero Coupon Bond Youtube

Yield To Maturity Ytm Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Yield To Maturity Ytm Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

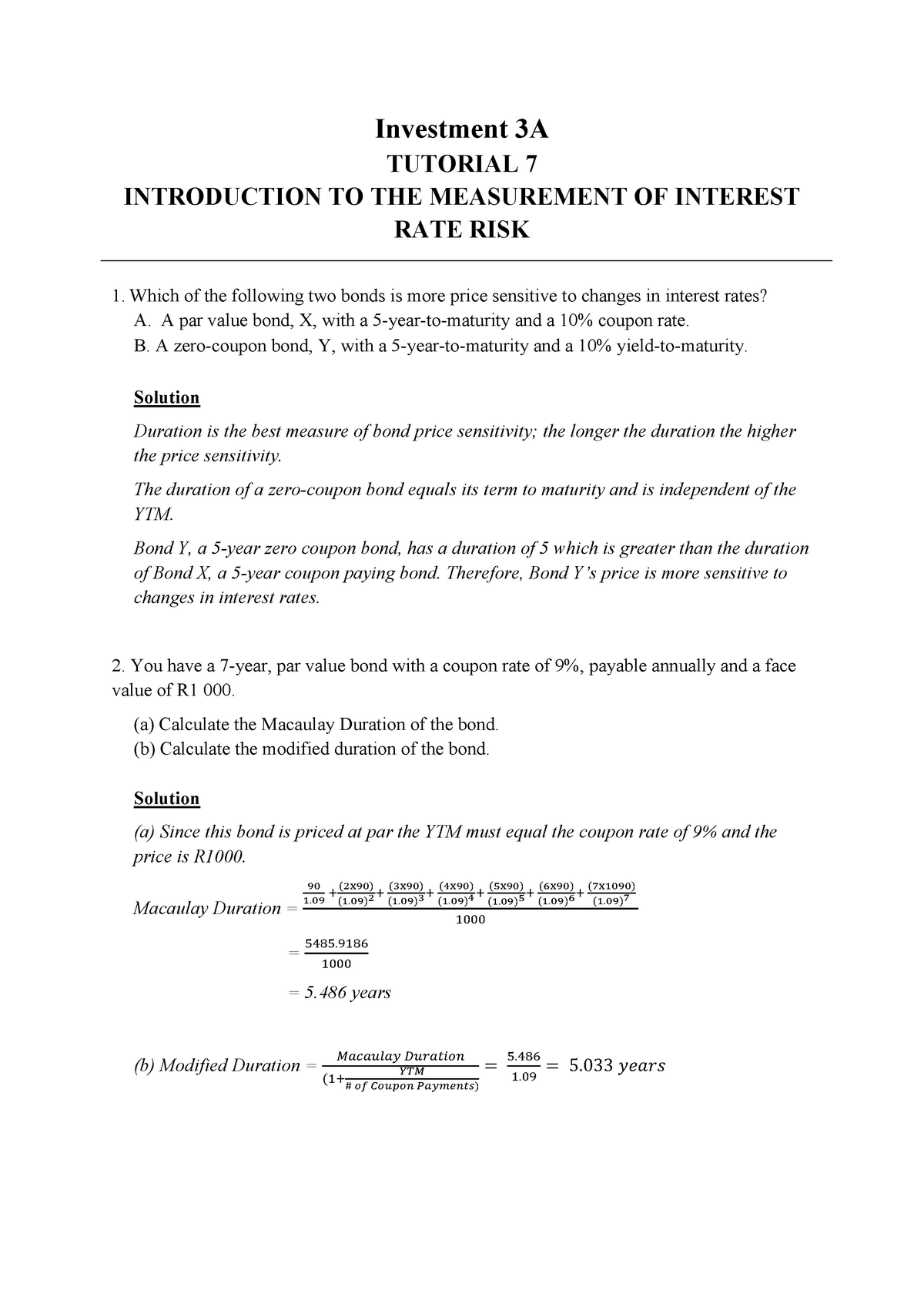

Class Tutorial Duration Convexity Solutions Studocu

Solved Write Down The Formula That Is Used To Calculate T Chegg Com

Bond Yield To Call Ytc Calculator

Zero Coupon Bond Yield Formula With Calculator

Chapter 11 Bond Yields And Prices Ppt Video Online Download

Bond Yield Formula Calculator Example With Excel Template

Solved Valuing Semiannual Coupon Bonds Bonds Often Pay A Chegg Com

Solved The Maturities And Prices Of Zero Coupon Bonds Are Chegg Com

%201.jpg)

Bond Valuation

Bond Price Calculator Present Value Of Future Cashflows Dqydj

What You Must Know On Bond Valuation And Yield To Maturity Acca Afm Got It Pass

Bond Net Yield To Maturity Calculator Eloquens

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Yield To Maturity Calculator Zero Coupon Bond

Calculating The Yield Of A Coupon Bond Using Excel Youtube

Valuing Bonds Boundless Finance

Pdf Exercise Session 2 Suggested Solutions Dmitry Bohatyrov Academia Edu

Berk Chapter 8 Valuing Bonds

Calculating The Yield To Maturity Mastering Python For Finance Second Edition

Bond Yield Calculator

Yield To Call Ytc Calculator

Yield To Maturity Formula Step By Step Calculation With Examples

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

What Is A Zero Coupon Bond

Yield To Maturity Fixed Income

How To Calculate Bond Price In Excel

What Is A Zero Coupon Bond

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Yield To Maturity Definition How To Calculate Ytm Pros Cons

Cost Of Debt Definition Formula Calculation Example

Q Tbn And9gctmjjcknhq5z6xqz1cb0 Ujolevox3tjfw K1tbrzk W Ikim Usqp Cau

Pin On Investing

Fin 301 Hw 7 Chapter 9 Fin 301 Studocu

Q Tbn And9gct1q6zxynbcvmgspi Wpg Zzjvgvz 1ltnjyviqmbaypurzxz Usqp Cau

The Following Is A List Of Prices For Zero Coupon Bonds Of Various Maturities A Calculate The Homeworklib

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

What Is Yield To Maturity How To Calculate It Scripbox

Valuing Bonds Boundless Finance

Faculty Math Illinois Edu Fengzhu2 Z Solution8 Pdf

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Learn To Calculate Yield To Maturity In Ms Excel

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Yield To Maturity Formula Step By Step Calculation With Examples

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

Calculate The Coupon Rate Of A Bond Youtube

Free Bond Valuation Yield To Maturity Spreadsheet

Yield Function Formula Examples Calculate Yield In Excel

Calculating And Using Implied Spot Zero Coupon Rates Bond Math

Tool To Calculate The Bond Price Using Python Exploring Finance

10 Bond Prices And Yields Ppt Video Online Download

Stata Codes For Calculating Yield To Maturity For Coupon Bonds Stataprofessor

How To Calculate Pv Of A Different Bond Type With Excel

Yield To Maturity Ytm Calculator

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

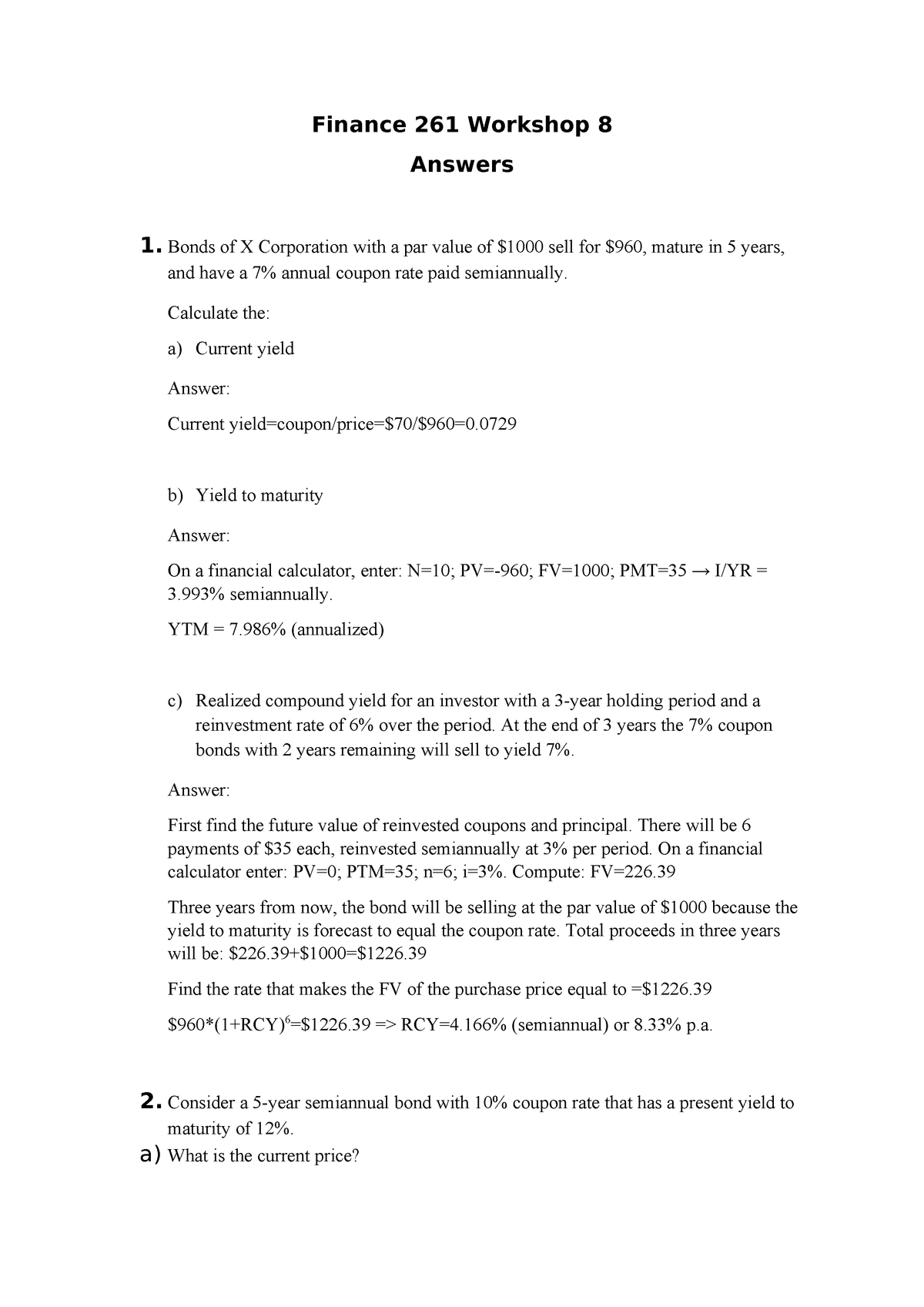

Workshop 8 Answers Finance 261 Fin261 Studocu

Bond Yields

Bond Formula How To Calculate A Bond Examples With Excel Template

Solved Chapter 7 Problem Set Students Must Show Work To Receive Full Credit Compute The Price Of A 9 Coupon Bond With Years To Maturity And A Course Hero

Http Kevinx Chiu Weebly Com Uploads 8 9 8 3 380 Homework 3 Solutions Pdf

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Worst What It Is And Why It S Important

How To Calculate Yield To Maturity 9 Steps With Pictures

コメント

コメントを投稿